2024 Business Auto Deduction – Knowing all of the auto-related deductions can ensure that your automobile is working as hard for you as you are for your paycheck. . Taking advantage of these often overlooked tax deductions can help you lower your tax bill. .

2024 Business Auto Deduction

Source : markjkohler.comBusiness Use of Vehicles | Maximize Tax Deductions

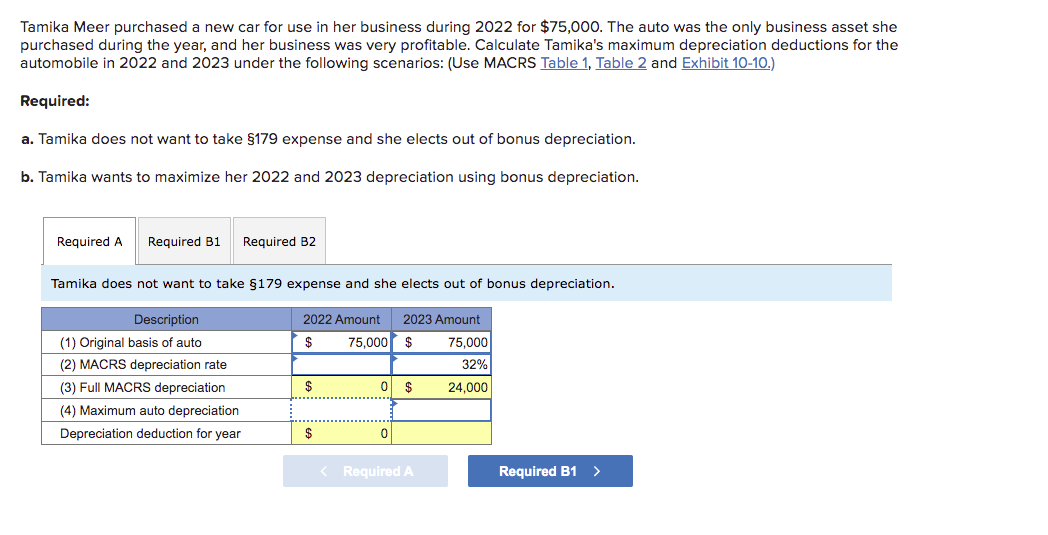

Source : www.patriotsoftware.comSolved Tamika Meer purchased a new car for use in her | Chegg.com

Source : www.chegg.comNew VW Cars & SUVs For Sale | Ciocca Volkswagen of Flemington

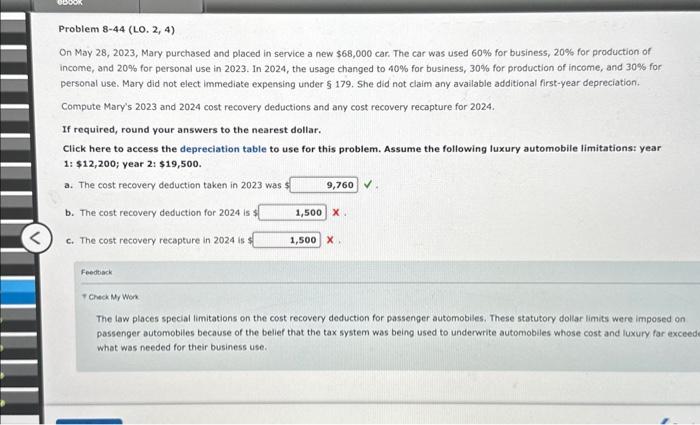

Source : www.cioccavolkswagenofflemington.comSolved On May 28,2023 , Mary purchased and placed in service

Source : www.chegg.comSection 179 Deduction – Section179.Org

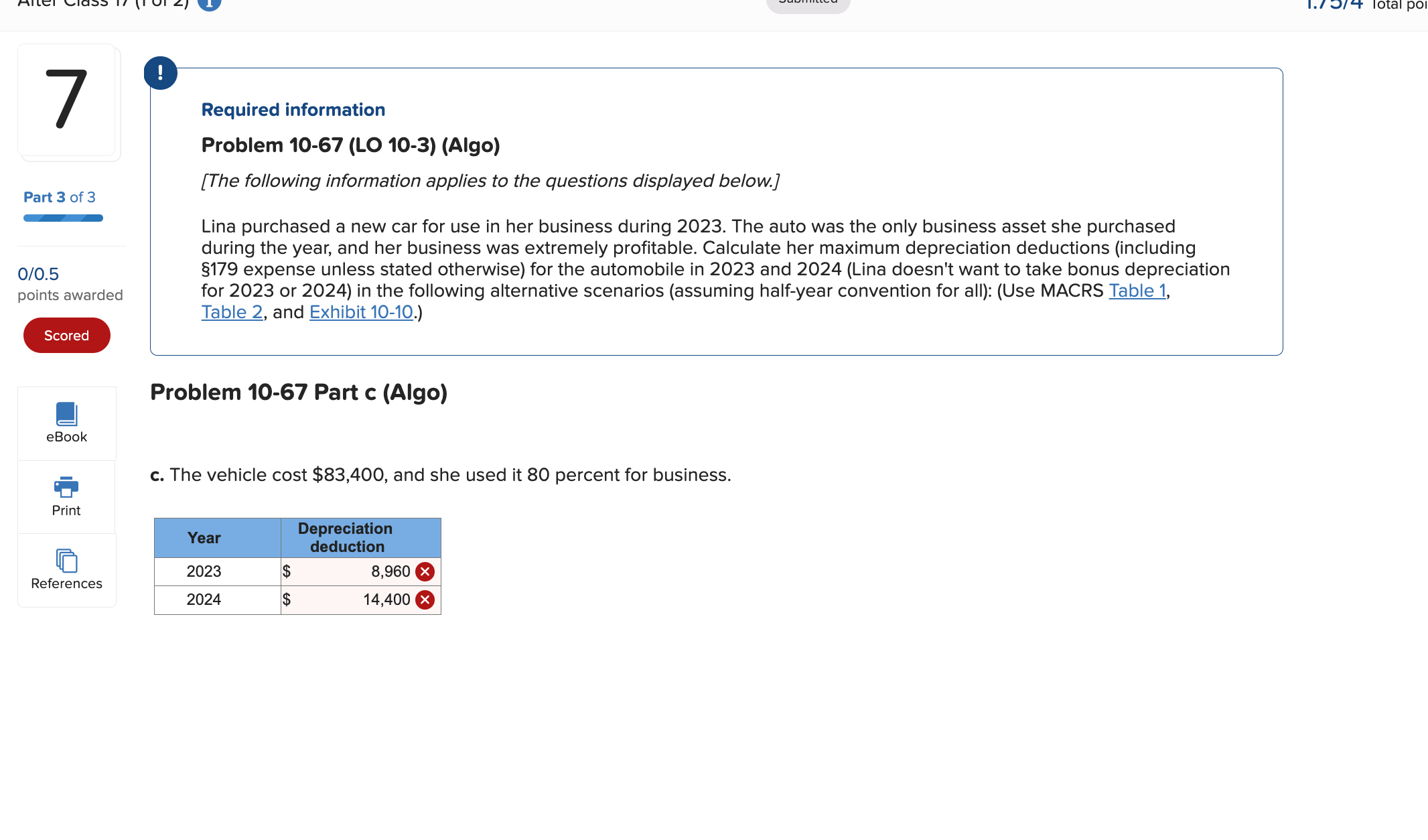

Source : www.section179.orgSolved Lina purchased a new car for use in her business | Chegg.com

Source : www.chegg.comRecent News

Source : cfla-acfl.caTaxAce 🚗💼 2024 Vehicle Mileage Rates Update 💼🚗 The IRS

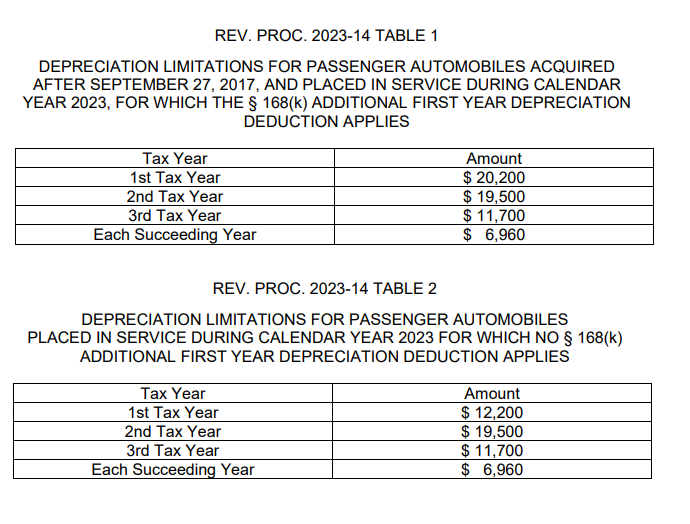

Source : m.facebook.comIRS Updates Auto Depreciation Limits for 2023

Source : www.eidebailly.com2024 Business Auto Deduction The Best Auto Deduction Strategies for Business Owners in 2024 : There is good news from the IRS this year. The standard deduction that people are allowed to take has gone up. . Taxpayers who claim the standard mileage rate deduction for the miles they log for business purposes will be able to write off 67 cents per mile in 2024, the IRS recently announced. That is up 1.5 .

]]>